Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Obotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature.

Low vs. High Asset Turnover Ratios

A more in-depth, weighted average calculation can be used, but it is not necessary. Different industries have varying levels of capital intensity, which directly impacts how assets are used to drive revenue. The asset turnover ratio is a financial metric that evaluates how effectively your business uses its assets to produce revenue. There is no single number that represents a good total asset turnover ratio, because each industry has different business models. It also depends on the ratio of labor costs to capital required, i.e. whether the process is labor intensive or capital intensive. An asset turnover ratio equal to one means the net sales of a company for a specific period are equal to the average assets for that period.

Asset Turnover Ratio: Understanding Its Significance and Limitations in Financial Analysis

- Companies with fewer assets on their balance sheet (e.g., software companies) tend to have higher ratios than companies with business models that require significant spending on assets.

- Due to the varying nature of different industries, it is most valuable when compared across companies within the same sector.

- As fixed assets are usually a large portion of a company’s investments, this metric is useful to assess the ability of a company’s management.

- Meanwhile, firms in sectors like utilities or manufacturing tend to have large asset bases, which translates to lower asset turnover.

- When a firm exhibits a high asset turnover ratio, it often implies that the company is utilizing its assets efficiently to generate sales.

As at 1 January 20X1, Gamma had total assets of $100, total fixed assets of $60 and net working capital of $20. During FY 20X1 it generated sales of $200 with COGS of $160 and its total assets as at 30 December 20X1 were $120. During the year it charged depreciation of $10 and there were no fixed asset additions during the year. Calculate total asset turnover, fixed asset turnover and working capital turnover ratios. Sometimes investors also want to see how companies use more specific assets like fixed assets and current assets. The fixed asset turnover ratio and the working capital ratio are turnover ratios similar to the asset turnover ratio that are often used to calculate the efficiency of these asset classes.

What Is Asset Turnover Ratio and How Is It Calculated?

An asset turnover ratio is a ratio that compares the total amount of a company’s net sales in dollar amount to the total amount of assets that was used to generate the stated amount of net sales. This means that an asset turnover ratio interpretation tells us how efficiently the assets of a company are deployed to generate revenue. Therefore, a higher value of this ratio is usually interpreted as a company using its assets well enough to generate its net sales or revenue. In this article, we will discuss the asset turnover ratio interpretation and how to interpret it with examples.

Total Asset Turnover Ratio Formula

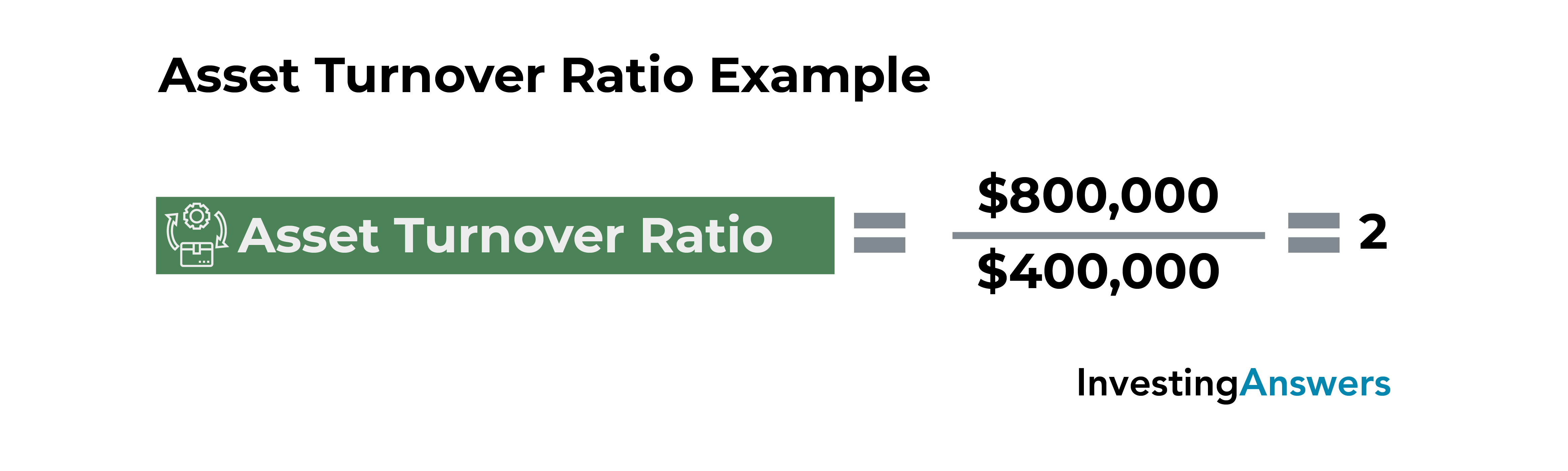

A technology company like Meta has a significantly smaller fixed asset base than a manufacturing giant like Caterpillar. In this example, Caterpillar’s fixed asset turnover ratio is more relevant and should hold more weight for analysts than Meta’s FAT ratio. Like with most ratios, the asset turnover ratio accessories is based on industry standards. To get a true sense of how well a company’s assets are being used, it must be compared to other companies in its industry. The asset turnover ratio is calculated by dividing the net sales of a company by the average balance of the total assets belonging to the company.

How to calculate the fixed asset turnover — The fixed asset turnover ratio formula

Depreciation is the allocation of the cost of a fixed asset, which is expensed each year throughout the asset’s useful life. Typically, a higher fixed asset turnover ratio indicates that a company has more effectively utilized its investment in fixed assets to generate revenue. The asset turnover ratio uses the value of a company’s assets in the denominator of the formula. The average value of the assets for the year is determined using the value of the company’s assets on the balance sheet as of the start of the year and at the end of the year. Total sales or revenue is found on the company’s income statement and is the numerator. The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets.

It is an asset-utilization ratio which tells us how efficiently the company is using its assets to generate revenue. This ratio measures how efficiently a firm uses its assets to generate sales, so a higher ratio is always more favorable. Higher turnover ratios mean the company is using its assets more efficiently.

While asset turnover provides a lens into operational efficiency, ROA offers a broader view of overall profitability. Analysts often use both metrics in tandem to assess whether high sales volumes are indeed yielding adequate profits after accounting for the costs of the assets employed. Asset turnover ratio is the ratio of a company’s net sales to its average total assets.

This metric is also used to analyze companies that invest heavily in PP&E or long-term assets, such as the manufacturing industry. The asset turnover ratio interpretation is relevant when evaluating the efficiency of a company’s operation. This ratio tells us how effectively a company is using its assets to generate revenue or sales for an accounting period. Hence, the interpretation of the asset turnover ratio means the higher the ratio, the more efficient a company is at generating revenue from its assets.