Company A has an ROE of 40% ($240m ÷ $600m), but Company B has an ROE of 30% ($240m ÷ $800m), with the lower ROE % being due to the 2nd company carrying less debt on its B/S. Therefore, the fact that the company requires fewer funds to produce more output can lead to more favorable terms, especially in early-stage companies and start-ups. Store A has managed to earn the same income with less equity, leading to a higher ROE. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

What is the approximate value of your cash savings and other investments?

The return on equity (ROE) cannot be used as a standalone metric, as it is prone to be affected by discretionary management decisions and one-time events. The return on equity (ROE) metric provides useful insights into how efficiently existing and new equity invested into the company is being utilized. Typically expressed in percentage form, the ROE metric can be a very useful tool to gauge a management team’s capital allocation decisions and ability to drive shareholder value creation. ROE, therefore, is sometimes used to estimate how efficiently a company’s management is able to generate profit with the assets they have available. These strategies require careful planning and analysis of the company’s financial and operational status to ensure effective implementation. ROE offers a broader perspective, while ROCE is ideal for companies relying heavily on borrowed assets.

Negative Net Income

ROCE measures the profitability and efficiency of a company’s operations and is a valuable tool for evaluating its financial performance. When interpreting ROCE, investors should consider various factors and analyze it in conjunction with other financial metrics and industry benchmarks. Firstly, investors should compare the company’s irs form 2106 ROCE with its historical performance and competitors’ average ROCE to determine the relative performance. If the company’s ROCE has been consistently higher than its historical average and industry average, it indicates that the company has been consistently profitable and efficient in utilizing its equity capital.

Return on Equity Calculation Example (ROE)

This ratio provides valuable insights into the potential profitability of funds invested in a company. A high ROCE signals an enticing investment opportunity, whereas a low one should prompt caution among potential investors. While helpful, ROE should not be the only metric used to gauge a company’s financial health and prospects. When taken alone, there are a number of ways that the ROE calculation can be misleading. In finance, Return on Common Stockholders’ Equity (ROE) is crucial for comparing profitability and growth metrics across different industries and within peer groups. Analysts also consider ROE from a management standpoint, as it helps evaluate the team’s effectiveness in using investment capital to develop new products, streamline operations, or expand market share.

ROCE is a percentage ratio calculated by dividing the company’s net income by the common equity, excluding retained earnings, and multiplying the result by 100%. Similarly, if a company has several years of losses, which would reduce shareholder equity, a suddenly profitable year could give it a high ROE, simply because its asset-based denominator has shrunk so much. The underlying financial health of the company, however, would not have improved, meaning the company might not have suddenly become a good investment. Net profit margin is a crucial indicator of a company’s efficiency in converting sales into profits. A high net profit margin increases ROE because the company generates more net income from each dollar of revenue. Net profit margin considers all expenses, taxes, and interest, and the resulting net profits significantly influence the equity holders’ returns.

- Moreover, dividends to preferred shareholders can also affect a company’s performance, and investors should consider this aspect when analyzing financial statements.

- By analyzing a company’s income statement and balance sheet, you can compute ROE by dividing the net income by the equity capital.

- This can be a particular concern for fast-expanding growth companies, like many startups.

- ROCE is a crucial financial ratio that investors use to evaluate a company’s financial performance and profitability.

- Return on assets (ROA) and ROE are similar in that they are both trying to gauge how efficiently the company generates its profits.

What Is a Good ROE?

Low ROCE may result in a lack of investor confidence and reduced valuation of the company. Firstly, it provides a clear picture of how efficiently a company generates profits with its available equity capital and helps to identify the best performers in the industry. Secondly, ROCE facilitates easy comparison of companies with different capital structures and sizes, as it considers only the returns generated by common equity. Thirdly, ROCE is a forward-looking financial metric that helps analysts and investors predict future profitability based on past performance. The return on common stockholders’ equity (ROE) gauges a company’s proficiency in generating profits from its equity.

Like any other financial ratio, return on common equity should not be used in isolation. Expressed in percentages, this is the rate of return that common stockholders get if they acquired stocks at par value, which is recorded in the balance sheet. One approach is to decrease the total amount of shareholder equity, which can be achieved by buying back some of its own shares from investors. A strong ROE ratio varies by industry, but generally, an ROE above 15% to 20% is considered strong, indicating effective use of shareholders’ equity to generate profits.

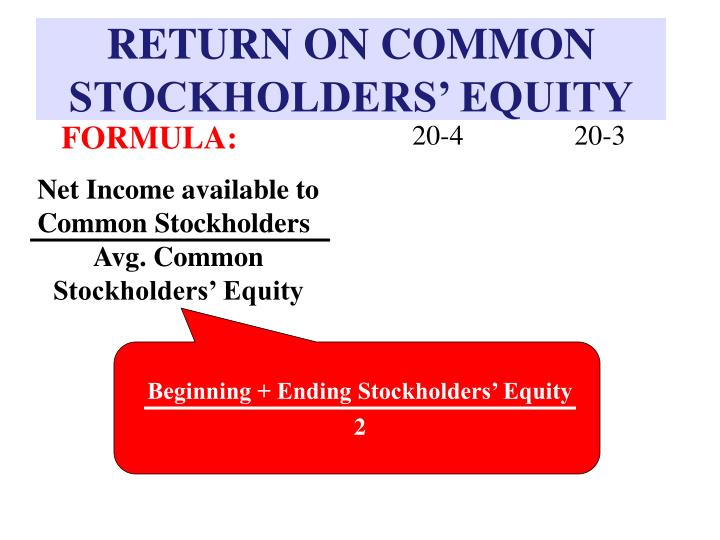

To learn more, go straight to the paragraph titled return on equity vs. return on capital. When investors provide capital to companies, they also invest in the ability of management to spend their capital on profitable projects without wasting the capital or using it for their own benefit. Let’s take the example of Company C, a successful technology company that has consistently reported high profitability and efficiency. NYU professor Aswath Damodaran calculates the average ROE for a number of industries and has determined that the market averaged an ROE of 8.25% as of January 2021. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Average equity is calculated by adding the equity at the beginning of the year to the equity at the end of the year and dividing the total by 2.

The return on equity ratio or ROE is a profitability ratio that measures the ability of a firm to generate profits from its shareholders investments in the company. In other words, the return on equity ratio shows how much profit each dollar of common stockholders’ equity generates. Return on common stockholders’ equity is calculated by dividing a company’s net income by its average common stockholders’ equity. This formula highlights the returns generated specifically on the equity held by common shareholders. Understanding this calculation is essential for investors evaluating a company’s profitability relative to shareholder equity.

In this case, preferred dividends are not included in the calculation because these profits are not available to common stockholders. It involves the company’s net income and the average common equity over a specific period. Net income is the profit after all expenses, taxes, and interest are deducted from total revenue, which represents the return generated for shareholders. The return on common stockholders equity ratio, also known as ROE, is a vital metric used for evaluating a company’s financial health. A high return on equity typically signifies that a company effectively utilizes its equity base to generate profits.