Банковские переводы

With most online bookmakers there are certain restrictions in place which are linked to payment methods used. Ewallets deposits are many times excluded from bonus qualification because of potential bonus abuse https://badgerboats.ru/themes/middle/?kak-rabotaiet-marafon-chieriez-ts-upis-chto-vazhno-znat-ighroku.html. On the other hand, cryptocurrency adoption has reshaped bonus accessibility. Some platforms started to prioritize crypto deposits with instant processing.

Welcome bonuses are a fantastic way to kickstart your online casino experience. Understanding their terms, selecting the right bonus, and avoiding common mistakes will maximize your enjoyment and winning potential.

The accounts that give you the most money for signing up are investment brokerages or banks (via credit cards or savings accounts). However, they typically have strict requirements for earning a bonus. For example, Moomoo currently offers up to 16 free stocks for opening an account and depositing $1,000. Similarly, large brokerage account deposit bonuses can be found on platforms like TradeStation, which offers a $150 bonus for making a $500 investment.

Many of these casinos prioritize flexibility, with platforms enabling crypto payouts to accommodate digital asset users. Casino registration bonuses offer a good starting point for most users, with packages that enhance the gaming experience.

Access to international exchanges

If you want to invest in US stocks from overseas, you’ll need to find a broker that allows you to trade on US stock exchanges. The options available vary depending on where you live, so research the best international stock brokers in your country.

Prosecuting fraud that occurs online is difficult. Prosecuting fraud that occurs online across international borders is virtually impossible. Look for a brokerage that offers enhanced account security options (like personal question account recovery features or two-factor authentication) and make sure that you turn these features on.

For example, the Australian Securities Exchange is open between the hours of 10 a.m. and 4 p.m. local time; this means that if you want to trade Australian stocks and you’re in New York City, you’ll need to be prepared to trade between the hours of 6 p.m. and midnight Eastern time.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Finder US is an information service that allows you to compare different products and providers. We do not recommend specific products or providers, however may receive a commission from the providers we promote and feature. Learn more about how we make money.

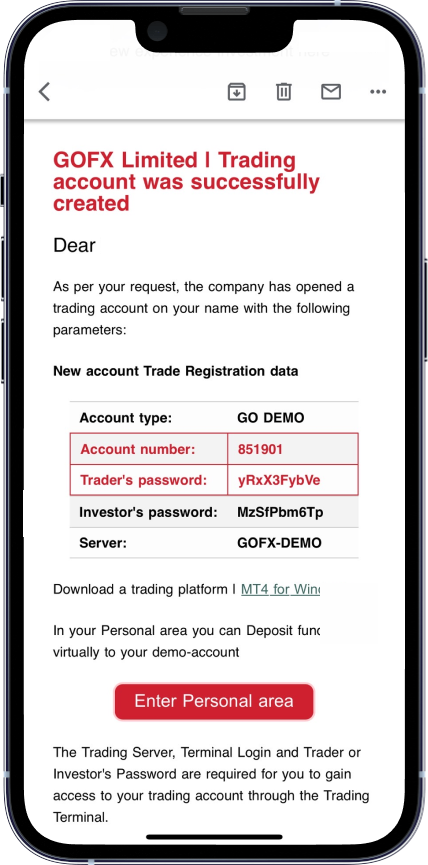

Demo account for beginners

You will usually be asked for your email address, username, password and location. Often you require no more details than this. Your account login details will then be emailed to you and instructions on the next steps will be given.

With good brokers, there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers, you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

Trading Futures and Options on Futures involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative of future results.

With Libertex you will have access to more than 250 hand-selected markets including stocks, cryptos, forex, and metals as well as more niche assets. I will be the first one to admit that the selection of assets is more limited than with some of the much bigger trading companies on this list. Still, it offers everything you need in terms of indicators, trading platforms, and lucrative trading conditions. The target audience of Libertex is mostly traders with some experience, which explains the lack of educational material or extensive trading information on the site. However, especially if you are looking to load your trading account via PayPal later, I highly recommend giving Libertex a shot.

You will usually be asked for your email address, username, password and location. Often you require no more details than this. Your account login details will then be emailed to you and instructions on the next steps will be given.

With good brokers, there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers, you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

Commission-free profit withdrawal

Fees may vary depending on the investment vehicle selected. Zero commission fees for stock, ETF and options trades; zero transaction fees for over 4,400 mutual funds; robo-advisor Core Portfolios charges 0.30% annual advisory fee

Minimum deposit and balance requirements may vary depending on the investment vehicle selected. No account minimum for active investing through Schwab One® Brokerage Account. Automated investing through Schwab Intelligent Portfolios® requires a $5,000 minimum deposit

Novices can use Schwab’s ETF Select List to determine which funds are suited for their needs, while the Personalized Portfolio Builder tool creates a diversified portfolio based on information provided around financial goals. Advanced investors can access research and earnings reports, plus real-time news from sources like Morningstar and Credit Suisse.

As long as you’re investing in eligible U.S. securities, you won’t pay commissions with Ally Invest. ETFs include options from iShares and Vanguard, both known for low expense ratios. Investors can access educational tools such as a probability calculator and options chains. Ally requires a $100 minimum for managed portfolios, but doesn’t charge any advisory fees.

Robo-advisor: E*TRADE Core Portfolios IRA: E*TRADE Traditional, Roth, Rollover, Beneficiary, SEP and SIMPLE IRAs, IRA for Minors and E*TRADE Complete™ IRA Brokerage and trading: E*TRADE Trading Other: E*TRADE Coverdell ESA (Education Savings Account), Custodial Account for minors and small business retirement plans